Science-Driven Quantitative Solution

Deep Finance

Research

Quant Trading Multi-Strategy Approach Focused on Market Microstructure Inefficiencies

Technology

Algorithmic Trading & Automated Trading Systems for CTA Strategies on DeepFi platform

Advisory

Custom Quant Services From R&D Solutions to Technology Deployment

Services

Loading...

Research Background

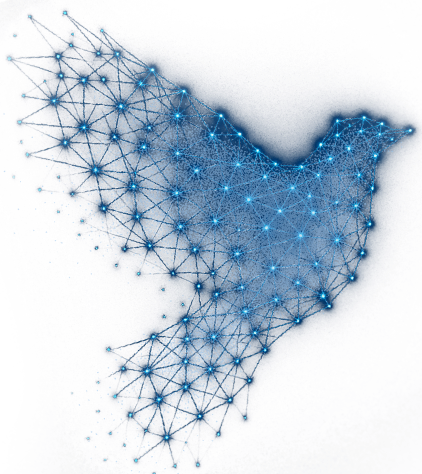

Dimtech Research Foundation’s work on financial market behavior draws on Giorgio Parisi’s swarm physics, particularly his spin glass theory and complex systems study. Parisi’s methods examine how individual market participants interact to create emergent behaviors. These insights help model market microstructure, where decentralized decisions lead to patterns like price fluctuations and volatility clustering. By combining AI with the Swarm approach, Dimtech analyzes vast financial data to uncover hidden patterns and market inefficiencies, providing a framework for understanding the self-organizing behavior of markets.

History

Founded in 2016 in Paris, Dimtech is a pioneering French laboratory dedicated to developing quantitative and systematic trading strategies, alongside advanced electronic trading execution systems. Our foundation rests on state-of-the-art technology and a collaborative culture rooted in academic excellence, driving continuous innovation and delivering consistent success.

Our Community

We bridge the gap between academia and industry through strategic collaborations with top universities and research institutions. Our commitment to innovation drives partnerships that advance financial technology and quantitative research.

Contact

Get in touch with us. Whether you have inquiries about our services, partnerships, or opportunities, our team is ready to assist you. Find our office locations, email, and phone details here.

- 124 rue Réaumur - 75002 Paris

- Contact@111dimtech.com

- +33 1 70 98 31 83